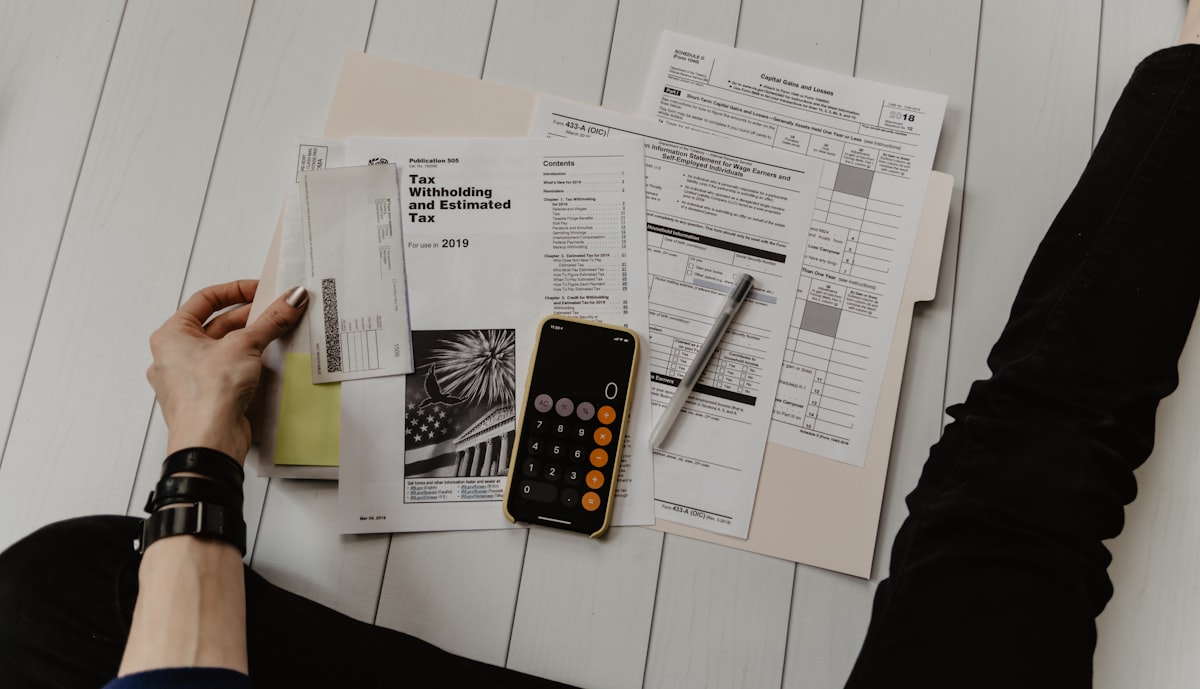

Home Office Tax Deductions in Germany: Complete Guide 2026

Maximize your tax deductions for home office expenses in Germany. Learn about the home office allowance, actual cost method, and...

Expert tips, practical guides, and current information on accounting, taxes, and finances for freelancers

Maximize your tax deductions for home office expenses in Germany. Learn about the home office allowance, actual cost method, and...

How to plan for retirement as a freelancer in Germany. Understanding pension systems, private retirement savings, and tax-advantaged options.

Everything you need to know about health insurance as a freelancer in Germany. Public vs. private insurance, costs, and how...

Comparison of the best accounting software for freelancers in Germany. Features, prices, and recommendations for different requirements.

Learn what a tax advisor costs for freelancers, when you need one, and what alternatives exist. Complete cost comparison and...

The comprehensive guide to accounting for freelancers in Germany. From basics to tax returns - everything you need to know....

Prepare for tax season with this comprehensive guide covering deadlines, required documents, common deductions, and tips for a smooth tax...

Learn how to calculate VAT correctly. Formulas, examples, and practical tips for freelancers and self-employed professionals in Germany.

Learn how to properly maintain income-expense accounting (EÜR). Step-by-step guide for freelancers and self-employed professionals in Germany.

The Kleinunternehmerregelung explained: requirements, advantages, disadvantages, and when it makes sense for you. Everything freelancers and self-employed professionals need to...

Learn what information must be included on invoices in Germany, how to number them correctly, and ensure your invoices meet...

Learn about VAT (Umsatzsteuer) in Germany, the Kleinunternehmerregelung, when you need to register, and how to handle VAT on your...

Discover what business expenses you can deduct as a freelancer in Germany to reduce your tax burden and maximize your...

Learn how to register as a freelancer in Germany, understand the difference between Freiberufler and Gewerbe, and get your tax...

Learn how to upload your VAT declaration (Umsatzsteuer-Voranmeldung) to ELSTER as a freelancer in Germany using data from Solobooks.

Receive monthly tips on accounting, taxes, and finances directly in your inbox